Looking Back to Plan Ahead

Analyzing the Great Recession to Prepare for the COVID-19 Recession

In June, the National Bureau of Economic Research officially announced that the country has been in a recession since February 2020 as a result of the COVID-19 pandemic. In that time, the stock market has fallen sharply and recovered almost as quickly, and unemployment numbers have hit levels not seen for nearly 100 years. What impact will a COVID-19 recession have on philanthropy? Unfortunately, my crystal ball is still at the cleaners, so our next best bet is to look back at the Great Recession of 2008 for some ideas of what may lie ahead for fundraisers.

Case Study: Wossamotta University

Let’s take a look at how the Great Recession impacted the fundraising efforts at Wossamotta University* (Wossamotta U for short). The university leadership has questions about what might happen as a result of a COVID-19 recession. I’ve put together this analysis to explore the effects the Great Recession had on giving activity at the university, the unique challenges a COVID-19 recession will pose, and what steps the university could take that might help prepare it for the difficult task of fundraising during and after a recession.

*Wossamotta U is a fictional university whose most notable alumni are Rocky the Flying Squirrel and Bullwinkle J. Moose. As such, the data shown here is fictional, randomly generated and modeled to simulate real-world giving data.

What Happened?

For this analysis, I examined giving activity at the university, and I have defined “giving activity” as the number of gifts made in a given fiscal year. You may be asking, “Steven, why don’t you look at the dollars raised instead of the number of gifts to measure the impact of a recession? Isn’t the amount of money brought in more important?” First off, excellent question, never stop asking questions. You certainly could put together a solid analysis using dollars instead of the number of gifts. However, if you only analyze the dollars raised, you could miss the broader trends and insights about how those dollars were raised. For example, a few big gifts could mask an otherwise poor fundraising performance with 15% fewer gifts. Just by looking at the dollars, everything seems hunky-dory, but the number of gifts is signalling that maybe there’s trouble brewing. Admittedly, it’s not a perfect solution, but looking at the number of gifts brought in each year gives us a cleaner representation of whether an organization’s fundraising activity is growing, shrinking, or holding steady.

Giving to Wossamotta U is divided into 3 levels based on the size of the gift: Annual, Major, and Principal. Each giving level has unique characteristics, and their donors are cultivated and solicited in different ways. Consequently, the Great Recession impacted each level differently, so it only makes sense to analyze them individually. This will allow us to glean deeper insights and make more tailored recommendations as opposed to generalizing across the whole university.

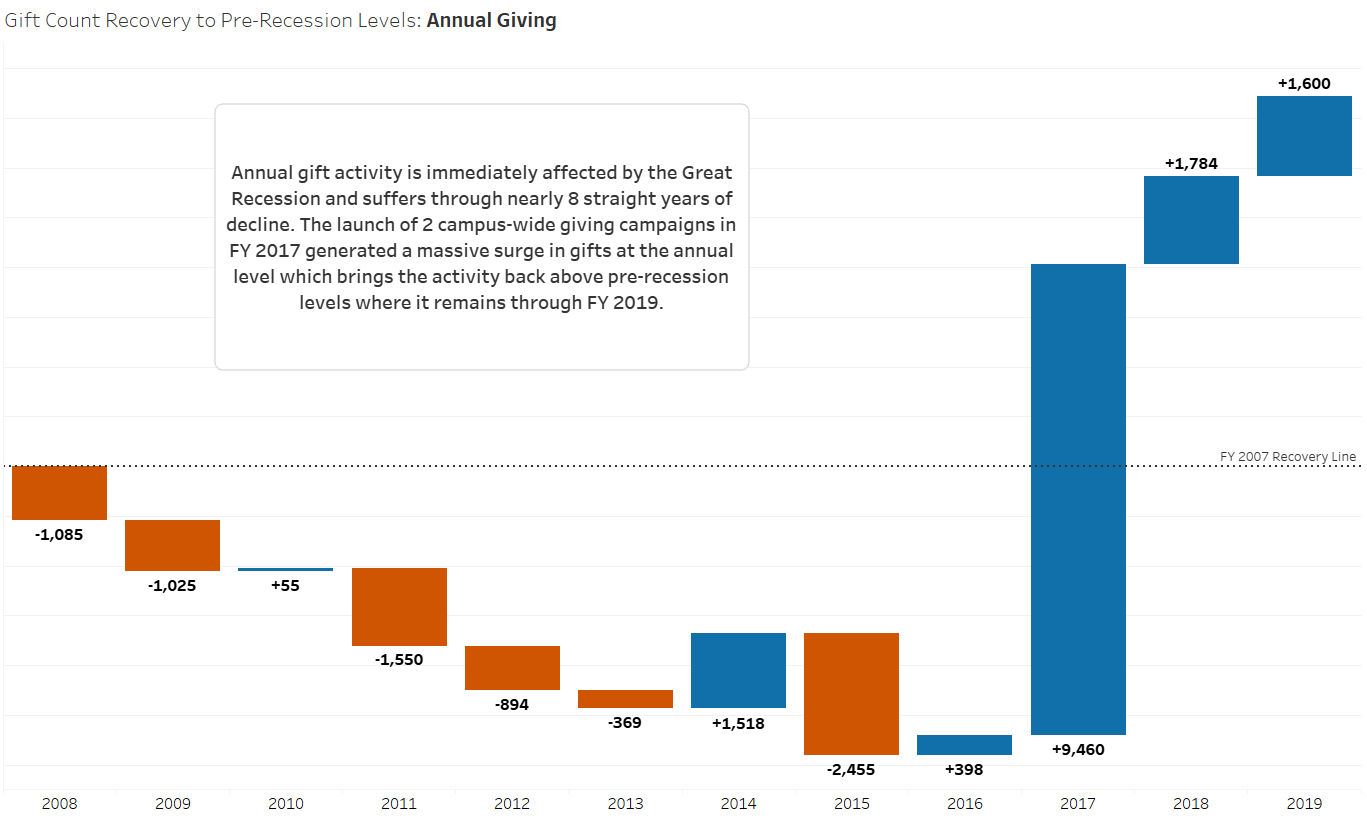

Annual Giving – Gifts made below $25,000

Annual giving is where the vast majority of gifts come in at Wossamotta U. Historically, roughly 98% of all gifts made to the university fall into this range. Gifts made at the annual giving level suffered a long period of decline following the Great Recession. For nearly 6 straight years from FY 2008-2013, the university received fewer gifts than the year before; FY 2010 saw an increase of 55 gifts more than in FY 2009, however a change that small in annual giving is negligible. A glimmer of hope appears in FY 2014 when giving activity increased by 9% over the prior year, but significant losses in FY 2015 push annual giving to its lowest levels since the recession began. The number of annual level gifts received in FY 2015 was nearly 6,000 less than before the recession began in FY 2007. That calculates out to a 26% decrease in giving activity over 8 years. It’s not clear what caused such a drop in FY 2015, but that year definitely warrants further investigation and conversations with university leadership to understand what happened and how it can be avoided in the future.

There was another modest increase in FY 2016, but the standout year for annual giving activity came in FY 2017 when Wossamotta U launched 2 campus-wide fundraising campaigns. These campaigns generated a huge spike in giving activity, fast-tracked the recovery of annual giving, and brought the number of gifts back above pre-recession levels. Without these campaigns, it is unclear when the university’s giving activity would have fully recovered, perhaps not until the early 2020’s.

Despite giving the smallest gifts, annual giving donors are crucial for the long-term health of an organization as they represent the best source of future major and principal donors. Following the Great Recession, Wossamotta U’s donor population shrank by nearly 25% from FY 2007 – 2015. This is a clear indicator that the pipeline of future major gifts was likely damaged and is in need of repair. Fortunately, the explosion of giving activity in FY 2017 represents an incredible opportunity to shore up the flow of donors from the annual giving level into major and principal levels. However, relying on massive fundraising campaigns to jump-start declining gift activity is not a viable long-term strategy, so it will be vital for the university to capitalize on the successes of FY 2017 and the continued growth in FYs 2018 and 2019.

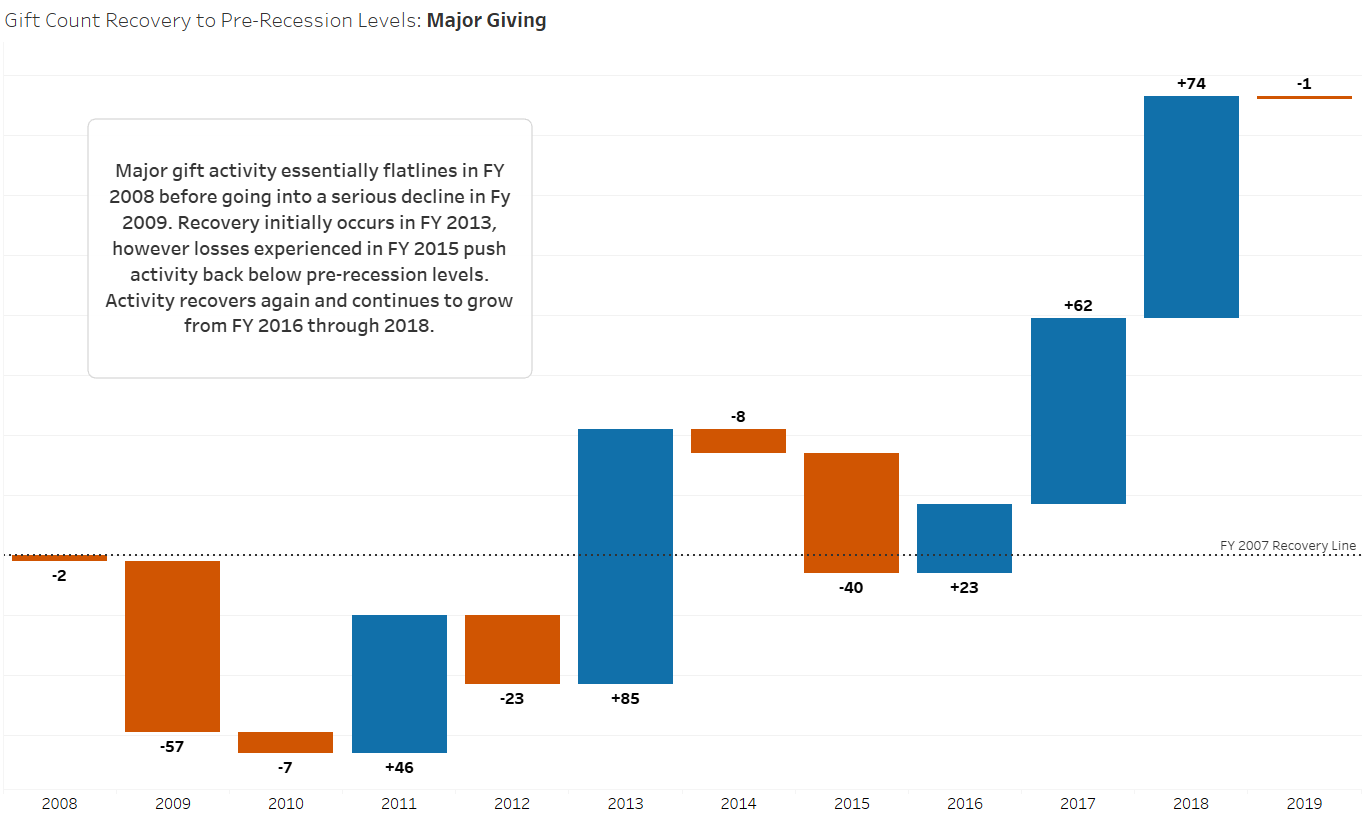

Major Giving – Gifts made between $25,000 and $1M

Major giving activity recovered much quicker than annual giving at Wossamotta U. By FY 2013, major gifts had recovered to pre-recession levels while annual giving numbers were still falling. Another difference between the giving levels is the initial impact of the recession. Major gift activity was essentially stagnant from FY 2007 to 2008 with only a marginal loss of 2 gifts, and then fell 17% below pre-recession levels in FY 2009. While annual giving saw immediate losses in the first year, major gift activity first slowed to a standstill and then experienced losses.

Similar to annual giving, major giving activity takes a hit in FY 2015. Activity falls by 10% and dips back below pre-recession levels but recovers by the next year and continues to grow through FY 2018. This dip further highlights how problematic FY 2015 was for fundraising at Wossamotta U. The impact from the 2 campus-wide fundraising campaigns in FY 2017 is somewhat evident in major gift activity, but certainly not as apparent as in annual giving. That’s not too surprising, because those types of massive fundraising campaigns tend to draw in large numbers of smaller donors with less significant bumps at the higher giving levels.

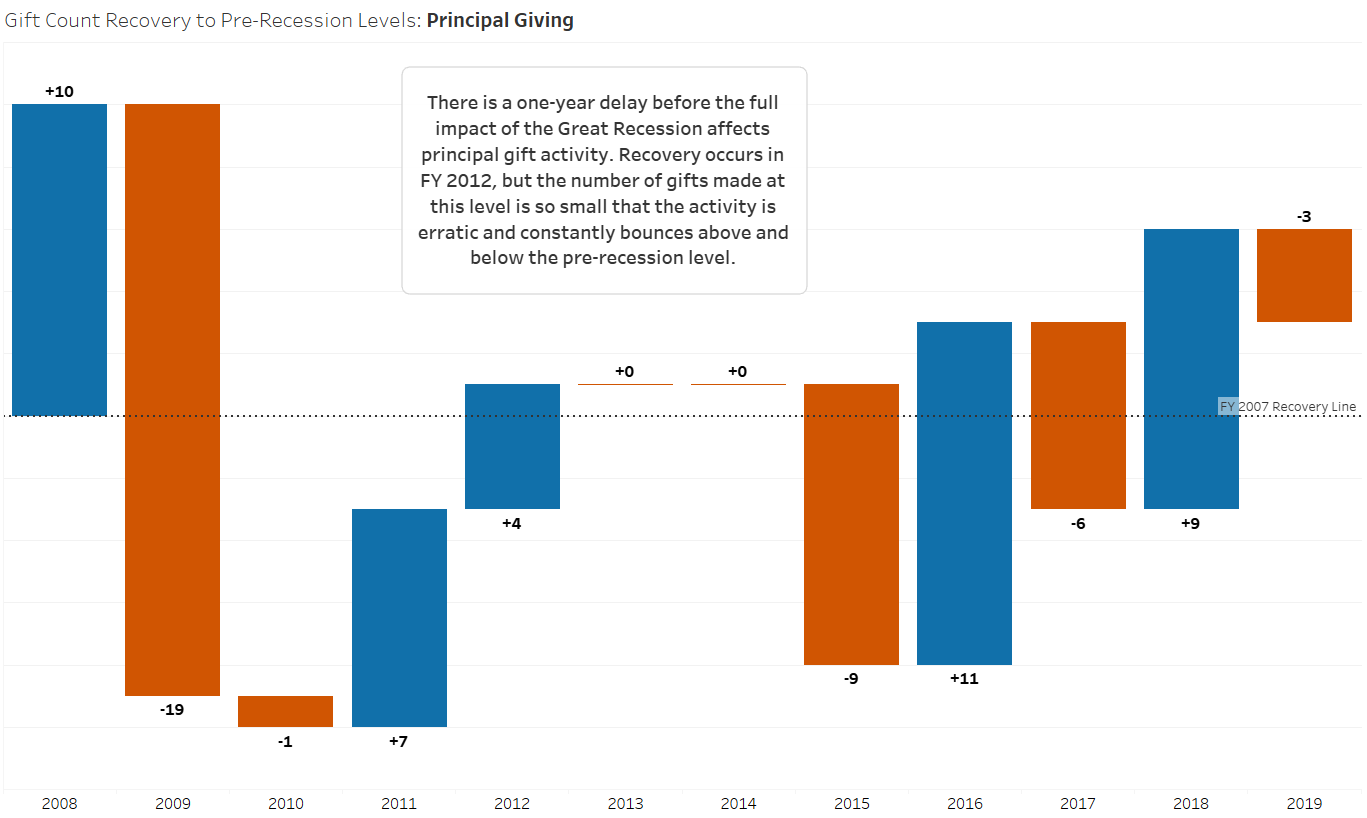

Principal Giving – Gifts made at $1M+

Principal giving activity follows a completely unique path from both major and annual giving. The most noticeable difference appears in FY 2008. While activity was falling at the annual level and stagnating at the major level, principal gift activity increased by 36%. How could it be that during the first year of a national economic recession, principal giving at Wossamotta U was on the rise?

One explanation may be that gifts of this size often take several years to coordinate and plan before finally being made. It’s possible that many of the principal gifts received in FY 2008 had already been set in motion and that the donor’s assets had already been liquidated or otherwise protected from market fluctuations. Estate gifts are another example of gifts that are decided on well before they are delivered to an organization. We also need to consider that gifts of this size are made by donors with extensive financial portfolios that may be better prepared to weather the storms of financial instability. Whatever the cause, there is a clear one-year delay on the impact of the Great Recession for principal gifts.

With this delay comes the risk of a false sense of security for university leadership. Although principal gifts account for only 0.1% of all gifts received at the university, they have generated 62% of the giving revenue on average over the past 20 years. Generally, it’s only 15-20 gifts that are bringing in over half the revenue for Wossamotta U. A one-year delay at this level gives the illusion that principal giving is not affected by a recession, and that the majority of revenue will still be coming in for the organization. This false security may lead to a lack of preparation and planning for an eventual decline.

We see that, sure enough, the decline does occur in FY 2009 when activity drops by 68%. Principal giving initially recovers in FY 2012, but beyond that, principal gift activity is erratic and bounces above and below pre-recession levels repeatedly. Because there are so few principal gifts made each year, minor fluctuations in the number of gifts appear as wild swings in activity from one year to the next. This is one of the downsides to measuring giving activity in this way. At the highest levels with the lowest gift counts, year-over-year comparisons can be messy and more difficult to draw valuable insights from. The most important takeaway is clear though, principal gifts are not immune from a recession, even if they initially appear to be.

Correlations with External Measures

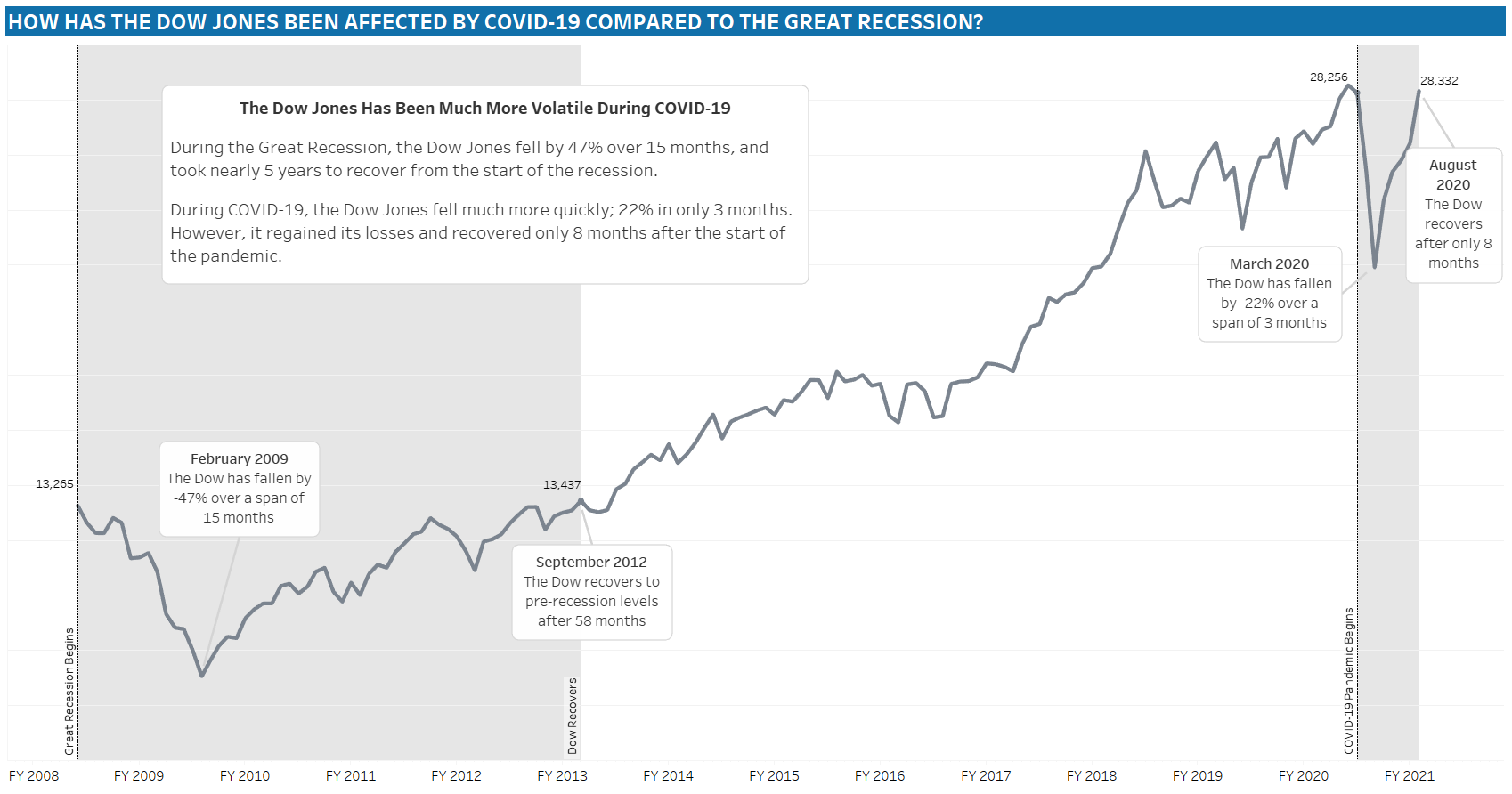

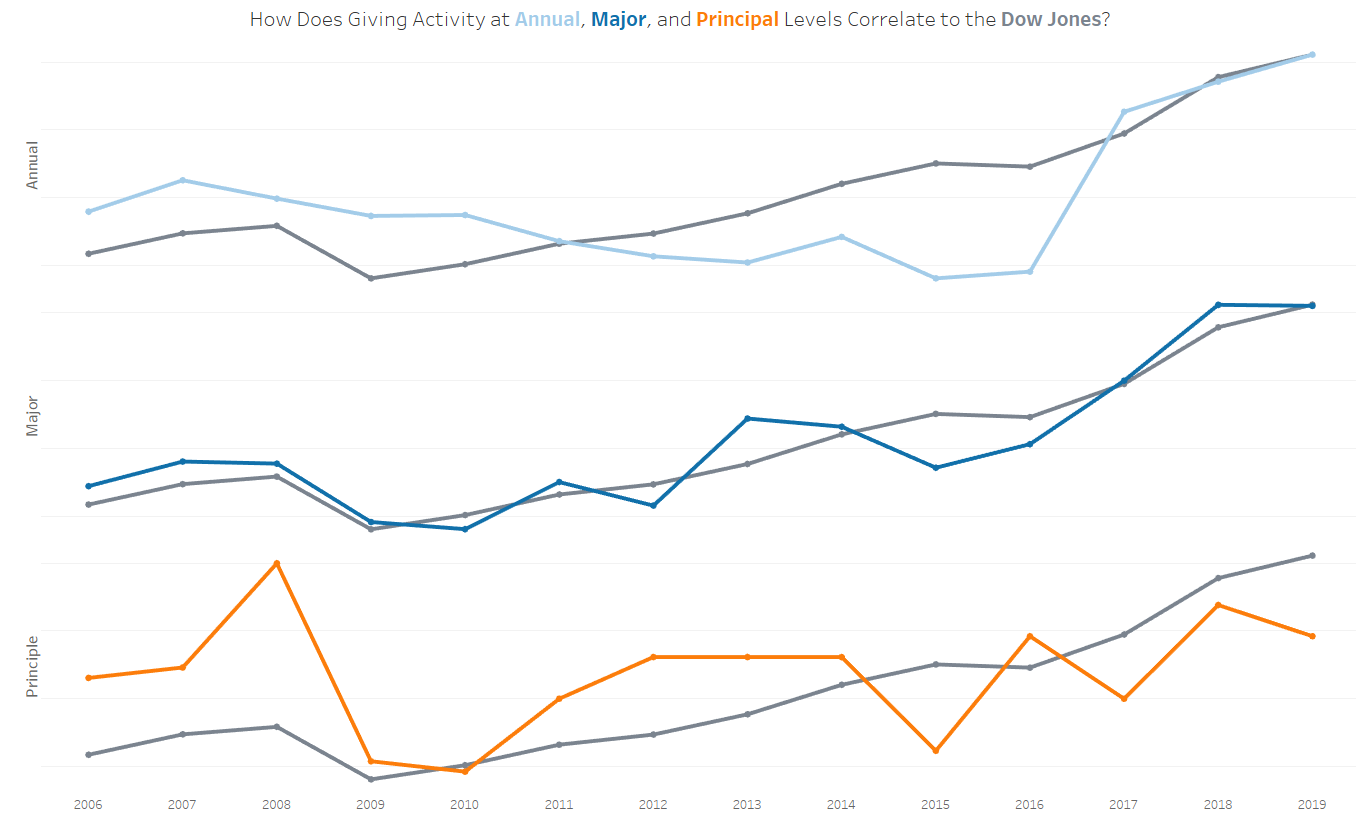

It would be helpful to understand how the university’s giving activity relates to to external economic indicators, so I explored several including the national unemployment rate, GDP, S&P 500 and the Dow Jones Industrial Average during the time of the Great Recession. Of these, there was only one correlation worth mentioning; major gift activity correlated strongly with the adjusted closing price of the Dow Jones Industrial Average. The correlation was only present at the major gift level; annual and principal giving did not have strong correlations. You can see in the chart below that the major giving line moves more in unison with the Dow line, while the annual and principal lines seem to move in their own patterns irrespective of how the Dow line moves.

This correlation is perhaps not all that surprising. Larger gifts are more likely to be based on a donor’s financial assets while smaller gifts are typically based on cash and disposable income. But if larger gifts correlate to the stock market, why is there essentially no correlation with principal gift activity? Principal gifts are rare, and the year over year activity is very erratic at the principal level. That erraticism makes it difficult to find any correlations with other measures.

How is COVID-19 Different from the Great Recession?

The above analysis will be helpful for the leaders at Wossamotta U to understand and prepare for what another recession might mean for giving activity. However, no two recessions are the same, and it’s important to recognize the unique challenges that a COVID-19 recession will present. We’re already seeing very different behavior and risks develop, particularly in external economic indicators.

Dow Jones: Then vs. Now

Early in 2020, the Dow Jones fell sharply losing 22% of its value in only 3 months. However, it quickly recovered those losses after another 5 months. This is vastly different behavior from the Dow of the Great Recession where the fall and recovery were slower and more gradual.

What could this mean for Wossamotta U? If major gift activity and the Dow continue to be correlated, it could mean that major gift activity may not experience much of a disruption because of how quickly the Dow recovered. Additionally, this pandemic is affecting business sectors differently. A donor who is heavily invested in medical supply or pharmaceutical companies is going to experience this recession very differently from a donor who is heavily invested in hospitality or travel companies. There may be donors out there who are seeing growth in their portfolios, not loss, and Wossamotta U may be able to capitalize and maintain some stability at its higher giving levels.

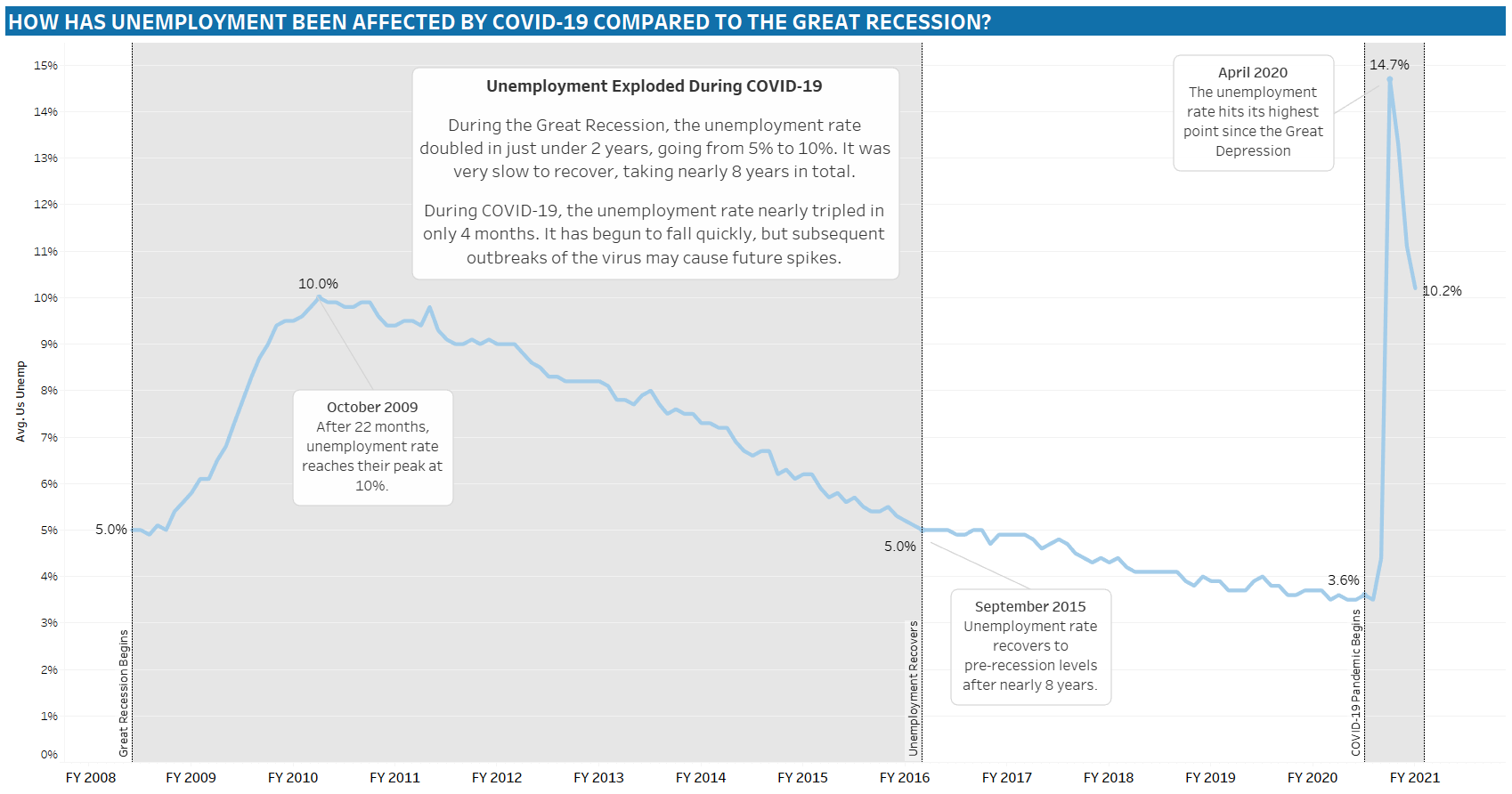

Unemployment: Then vs. Now

With the pandemic forcing businesses nationwide to shut down either temporarily or permanently, unemployment has reached historic levels very quickly. The country’s unemployment rate went from 3.6% to 14.7% in only 4 months. We haven’t seen unemployment numbers like that since the Great Depression in the 1930s. During the Great Recession of 2008, the country maxed out at 10% unemployment, and even that was after nearly 2 years of growth. COVID-19 has caused immediate, severe changes in both the Dow and unemployment, compared to the more gradual shifts seen during the Great Recession.

Although unemployment was not correlated to giving activity at Wossamotta U during the Great Recession, that relationship could change given the unprecedented levels of unemployment during COVID-19. Since April, the unemployment rate has been coming down each month, however potential second and third waves of outbreak could delay full recovery. Frankly, it’s very hard to tell when things will get back to “normal,” or what that would even look like in terms of employment figures.

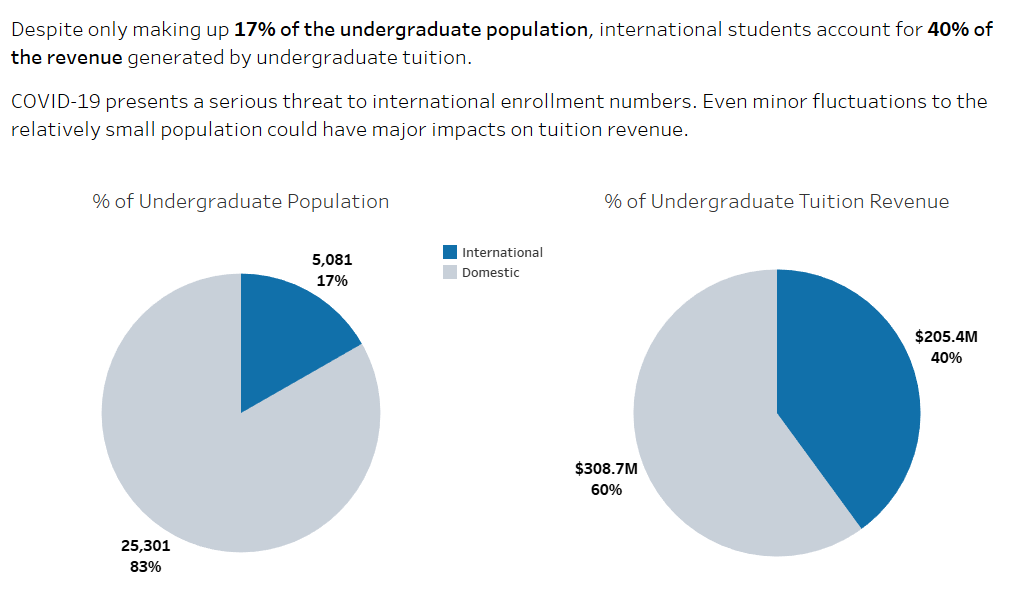

International Students will be a Factor

COVID-19 presents a unique threat to higher education institutions like Wossamotta U via restricted international travel, and subsequently international student enrollment. In response to the Great Recession, universities targeted international students, and their higher tuition rates, to recoup losses to their endowments and help offset budget cuts. The Pew Research Center found that from 2008 to 2016, the number of international students enrolled across the country increased by 104%, while overall enrollment growth was only 3.4%.

However, universities may now be too reliant on a revenue source that is threatened by COVID-19. At Wossamotta U, international undergraduate enrollment grew from 375 students in 2009 to over 5,000 in 2019, and the tuition generated by these students rose from $10M to over $205M. International undergraduates now make up 17% of the undergraduate population, but bring in 40% of the tuition revenue. Relying on a such a small population to generate significant revenue puts the university in a precarious position should enrollment decrease.

Unfortunately, international enrollment is likely to decrease in response to families being fearful of sending their children abroad during a global pandemic, federal restrictions on international travel, and students not wanting to pay regular tuition rates for an online-only college experience. If international enrollment dips by only 500 students at Wossamotta U, which seems plausible given the worldwide impact of the pandemic, the university would lose over $20M in a single year! And that’s just from tuition alone; we aren’t even considering the losses in student fees, textbook sales, or housing. The Great Recession led to a huge increase in international students, and the revenue they generate, at universities across the country. The COVID-19 recession will likely yield the opposite result, to the detriment of higher education nationally.

How Can Wossamotta U Prepare?

We know there will be a tough road ahead, but what are some actionable recommendations for the fundraising team at Wossamotta U to mitigate the threats and risks of a COVID-19 recession?

1. Focus more on retaining the donors you already have

Prioritizing donor retention over acquisition could help protect Wossamotta U from seeing the same pipeline deterioration they saw after the Great Recession. By increasing the number of donors who give consistently, the university will build a solid foundation of donors who have developed a connection to the university, and who are likely to still be there when times get tough. I’ll explore the concepts of donor retention and acquisition more in a future project, but generally, retaining existing donors is a more effective strategy than attempting to convert non-donors.

2. Don’t stop asking, just find the right asks to make

Wossamotta U should assess the employment and financial assets of their donors to identify any prospects who may not be suffering from the economic impacts of the recession. There may be donors who work in, or are invested in, industries that have grown during COVID-19. Industries like healthcare, logistics, and e-commerce and technology are poised to succeed during a pandemic where people are forced to stay at home most of the time. The university likely still has donors in position to make gifts, and during a recession, you need as many gifts as you can get. For Wossamotta U, it will be a matter of finding those donors.

3. Keep your eyes on the markets

The team should continue monitoring external economic indicators and their relationships to the university’s giving activity. During the Great Recession, we only saw a positive correlation between the Dow Jones and major gifts, but we have seen how differently the Dow Jones has behaved during COVID-19 compared to the Great Recession. That correlation may change, the Dow may start to more strongly correlate with annual or principal gifts, and new correlations may develop with other indicators such as unemployment. Any insights into how the broader economy relates to giving will help give Wossamotta U context around their data and may even provide some insight as to what to expect from their different giving levels.

4. Avoid a Repeat of FY 2015

FY 2015 proved problematic for fundraising at Wossamotta U, particularly at the annual and major gift levels. Getting to the bottom of what happened, and what challenges the university faced in that year, will be crucial to ensuring that it doesn’t happen again. Did any particular giving channel under perform significantly? Was there a specific giving campaign that fell flat? Were there any changes in leadership or priorities that may have impacted giving? Answers to these questions will go a long way to understanding what to avoid during a COVID-19 recession.

Conclusion

While nobody knows exactly what the future holds, or what specific impacts the COVID-19 recession will have on fundraising for an organization, we can plan and prepare based on what we know about the past and about the present. For Wossamotta U, that means looking back at what happened during the last major recession and understanding the unique complexities of a global pandemic happening now. Armed with the knowledge presented here, university leadership will be able to make data-informed decisions that minimize risk and capitalize on opportunities as they present themselves.